My investment journey began in 2023 with a book called “Trading Technical Analysis Masterclass: Master the Financial Markets” written by Rolf Schlotmann and Moritz Czubatinski. I read this book with no real appreciation of the difference between trading and investing, and therefore, while the techniques were interesting and inspiring, they didn’t help me develop the thinking patterns required for long-term investing.

After finishing the book, I took my £50 and purchased £1 in 50 separate stocks. Most of these were businesses I had never even heard of, and to be honest, I had no intention of looking into them either. I was distributing my money with a lottery mindset — thinking, which one of these £1 investments is going to make me thousands? The answer, as you’ve probably guessed, is none.

However, this exercise wasn’t without value. It gave me a glimpse of what happens when money is in the market. It showed me how it fluctuates throughout the day — how one moment a stock can appear to be soaring, and the next it’s in steep decline.

It was from this experience that my mindset began to shift. I no longer wanted to invest blindly. I realised the importance of understanding the businesses in which my money was being invested. I began asking deeper questions, reviewing companies with far greater scrutiny:

- How much profit are they making year on year?

- If they’re expecting lower-than-usual returns, why?

- Do they have a stable management structure?

- What are the biggest challenges they may face in the future, and are there signs these are being addressed?

- Are they considering shifts in demand and anticipating where that demand might come from?

- Do they have a positive media presence?

- Is their product something that will be needed in the future, or is it just a fad?

- Are they publishing their financial reports on time?

When you approach investing this way, you quickly come to appreciate that it’s not feasible to be this meticulous across 50 businesses — not as an individual investor with a day job. It was for this reason I sold off my 50 stocks and narrowed my focus to just a few. At the time, these were Amazon, Ford, Rolls-Royce, Apple, and 3M. Even then, I still found myself buying and selling a few others, reacting to how the market was moving.

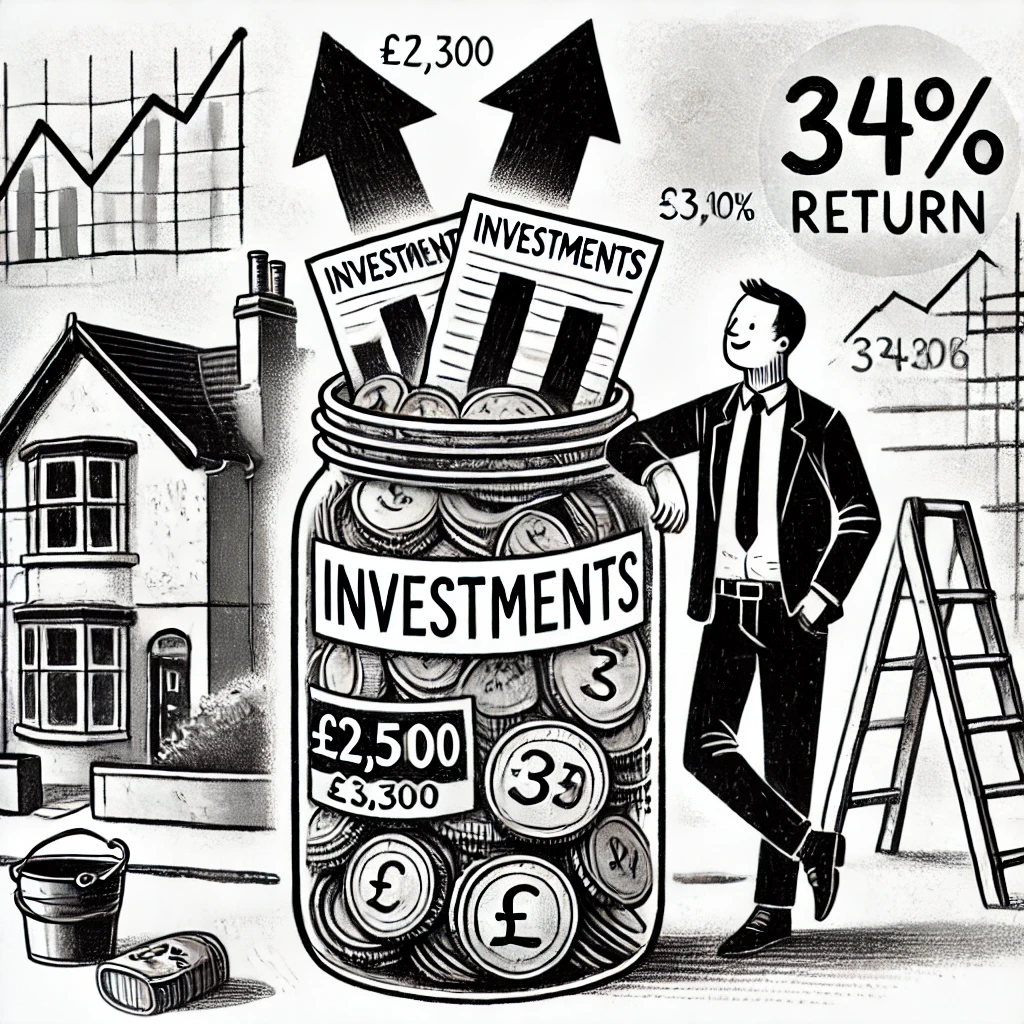

By the end of the 2023 financial year, I had invested £2,500 and made £850 on these investments — a 34% return. Around this time, we had some home improvement projects underway, which would increase the value of our property, so I withdrew the money to help fund these developments.

There is a quote from the book that has stuck with me throughout my journey:

Technical analysis is so effective because people always follow the same behavioural patterns and often make their trading decisions collectively based on similar emotions.

It’s easy to feel demotivated, knowing there’s money in play that sways the markets — and that there are people who thrive in manipulating these movements to create environments in which they can prosper. The quote above is a sobering reminder that many trends are driven by emotional reactions rather than logical deduction.

By taking the time to educate yourself about the businesses you’re investing in, you can begin to control the emotional aspect of investing. If you have confidence in a company’s stability and capability, then you’ll start to see the swings in the market for what they are — the result of larger forces at play and the emotional responses they trigger.

You’ll find your mentality changing. You’ll start buying more of the stocks you’ve researched during bearish markets, rather than rushing to sell at a loss. This was certainly true for me.

As my strategy evolved, I began to loosely categorise my investments in my mind. There were stocks I intended to hold through thick and thin, and others I watched closely — ready to sell if I noticed signs that might indicate a potential decline in value.

I wasn’t always right. Sometimes I sold a stock at what seemed like the beginning of a drop, only to see it bounce back shortly afterwards. Other times, my decision aligned perfectly with my goals — like selling shares in time with redundancy announcements and factory closures at Ford.

The importance of adopting a macro mindset has become increasingly clear to me. Rather than starting with a stock-first approach, I now begin with a broader world view. I ask: What is happening globally, and which industries are likely to be directly affected? From there, I explore the industries that support those primary sectors and consider how they might be influenced. Then, I identify key players within those industries and assess the likelihood of their involvement in light of current events. Only at this point do I begin analysing specific businesses, drilling down into their financials, operations, and future outlook.

This shift in philosophy has helped me become a more grounded investor — one who responds to the performance and fundamentals of the businesses I’m invested in, rather than reacting emotionally to the daily fluctuations in share prices. It has given me the confidence to invest larger sums of money on a more regular basis, with a clearer focus on long-term growth.

The Future

My journey is still unfolding, and I know there’s much more to learn — but with every step, I feel more intentional, informed, and resilient. Investing has become more than just a way to grow my wealth; it’s become a process of sharpening my thinking, understanding the world, and staying calm amidst the noise.

Throughout 2025, I aim to put what I have learned to the test and grow my £500 portfolio to £10,000 through regular deposits and sensible investments. I am sharing the progress of this journey, posting regular updates of the good and the bad. If your interested in how I manage this portfolio, do check out this link.