Investing can be an intimidating concept to anybody who has not done it before. We have all heard of people losing their entire savings through day trading and volatile stocks such as Bitcoin / Cryptocurrency. Ultimately, while there is always a risk to investing, you can reduce this to a point where there is more risk of leaving your money in an everyday bank account doing sweet f/a for you than there is by trying to grow your money by investing.

During the end of 2023 through 2024, I used the money accrued in my Trading212 account to fund development within my home with the goal of reducing the loan to value rate of my mortgage. At the current time, this stood out as sensible preparation to reduce the severity of any increase the mortgage rates which still seems likely to prevail.

On one side of the coin, it’s sad to see the trading account be reduced in value for these works to take place, but on the opposite side I love the investing game and look forward to the challenge of restoring its value.

This time, I want to document the journey to £10,000 and share it with you. I’ll record the highs and lows including both the mistakes, and the decisions that pay off – hoping there will be some good decisions!

I’ll record my investment strategies and the detail behind why I have chosen to build my portfolio in the way I have.

In documenting this journey, I hope to achieve a few things:

- I hope to give you the confidence to begin investing if you have not yet started your journey

- I hope to enhance my own learning by not only carrying out my own analysis and thoughts, but having to articulate that in writing – it is said you do not truly understand a topic if you can not share it with others.

- I want to share the knowledge that I gain with you, helping you to avoid the mistakes I make, decreasing the time it takes you to reach £10,000

- I want to grow my money by investing on a regular basis with the goal of reaching £10,000 as quickly as possible.

Disclaimer

I am not a financial adviser, and the information I share is based solely on my personal investment journey as an average individual. Please remember that past performance of the market is not a guarantee of future results. Always do your own research and consider seeking advice from a qualified professional before making any financial decisions. Only invest what you are willing to accept losing.

The Goals of the Project

To ensure there is clarity about what needs to be achieved and we can measure the progress throughout this project, I’ll outline the objectives below using the SMART system – who doesn’t love a good acronym.

Learn more about SMART goal setting in my guide: Setting SMART Goals – The Blueprint for Success.

S – Specifics

I would like grow my investment portfolio and share the journey with those who can benefit

M – Measurable

A final figure of £10,000 has been established for this project. The journey will be posted online where traffic can be monitored,

A – Achievable

The figure is achievable. 3 x time constraints will be put in place as a motivating factor, each slightly more tough to achieve than the next.

R – Relevant

This goal is relevant, acting as a stepping stone to larger investments in the future.

T – Time

Below outlines 3 separate finish dates…

- Gold – Complete before January 2026. The equivalent of £192 per week investing with no gains in the portfolio.

- Silver – Complete before July 2026. The equivalent of £128.20 per week investing with no gains in the portfolio.

- Bronze Complete before January 2027. The equivalent of £96.16 per week investing with no gains in the portfolio.

The Current Portfolio

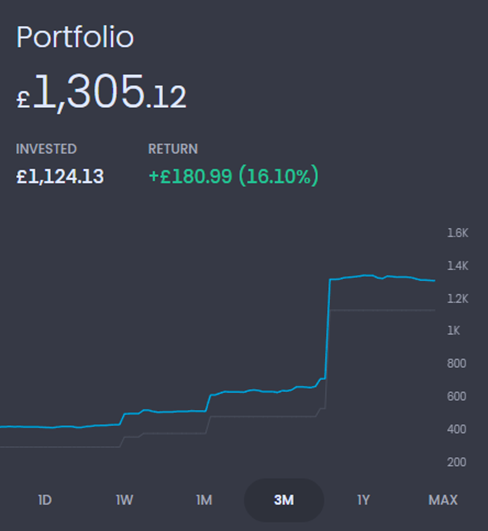

Snapshot – October 2024

Snapshot -November 2024

Let’s bring you up to speed! In October 2024, my portfolio was just shy of £500 inclusive of a healthy return rate of 40.65%.

At the beginning of December 2024 I then deposited an additional £750 into the Trading212 account. Within this deposit, I made my first mistake and placed £600 into the S&P 500 and the remainder into my existing holdings in one foul swoop. What I should have done, is harnessed the potential of a technique known as ‘Dollar Cost Averaging’

What is Dollar Cost Averaging?

Dollar Cost Averaging is the act of investing smaller sums of money on a more frequent basis, reducing the potential impact of price hikes due to volatility in the stock market.

To do this successfully, you should avoid investing your monthly deposit in one go. In doing so you, you are averaging the value paid for your stocks over 12 transactions. Instead, purchase stocks on a weekly basis averages your cost of purchase by 52 transactions, smoothing out the potential risk created by any volatility in the stock market.

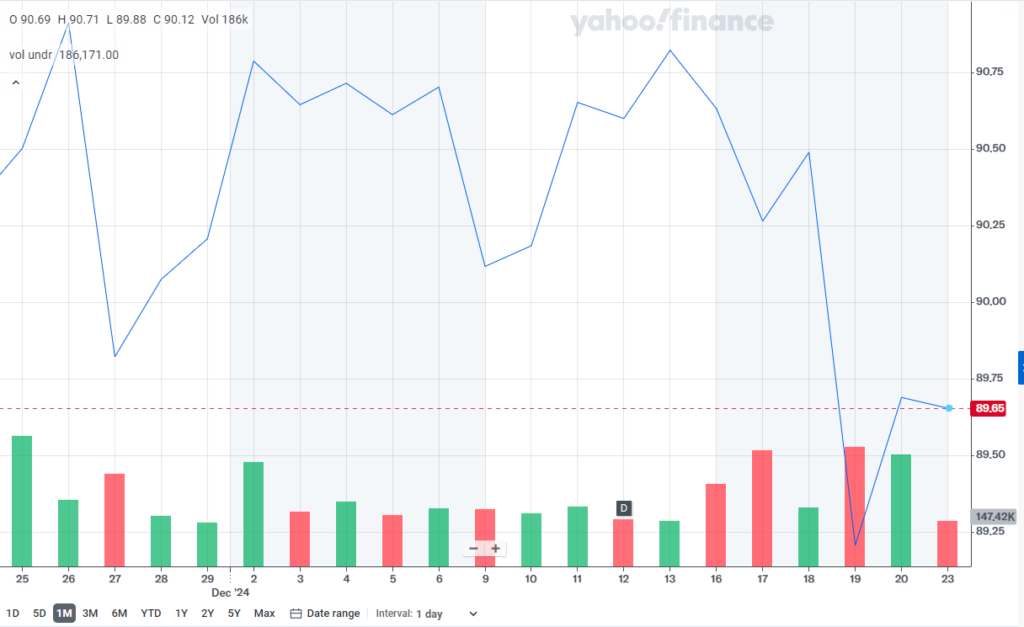

Let’s look at this in a real example of the S&P 500 for the first 3 weeks of December 2024, assuming we have £500 to invest for the month:

Method 1 – We invest our entire monthly budget on the first Monday of the month. The stock price on Monday 2nd was £90.79 per share.

£500 / £90.79 = 5.50 shares acquired with the average price of £90.79 per share.

Method 2 – We invest in 4 equal proportions of the £500 sum per week (£125 per week).

- Week 1 – £90.79 per share = 1.37 shares acquired

- Week 2 – £90.12 per share = 1.38 shares acquired

- Week 3 – £90.63 per share = 1.38 shares acquired

- Week 4 – £89.74 per share = 1.39 shares acquired

The average price paid using this method was £90.58 per share which is £1.16 less over this timeframe.

While we are dealing with small sums of money here, you can quickly see by implementing techniques such as this one we maximise the output of our capital. These small gains all add up and should not be overlooked if you do truly want to grow your money by investing.

Portfolio Make-Up

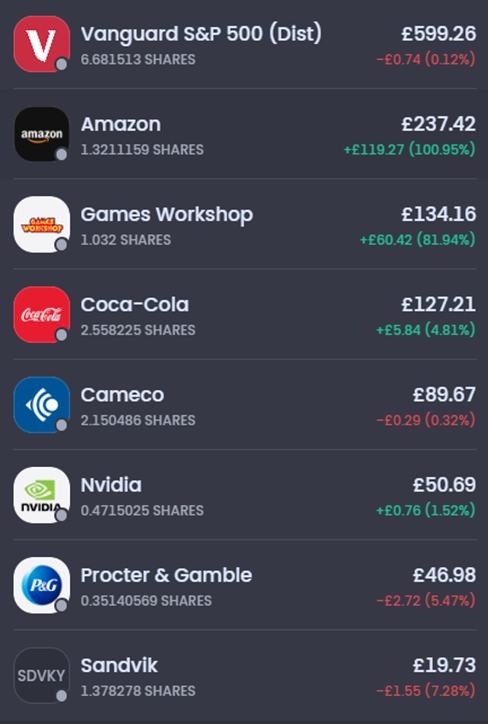

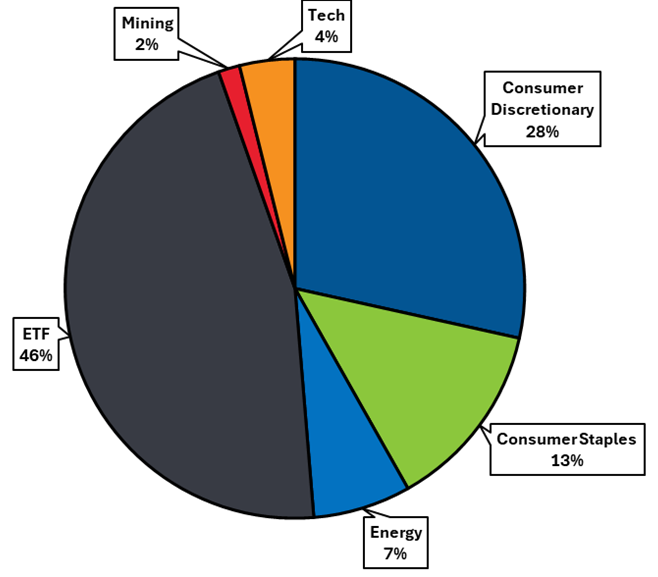

My current portfolio consists of 8 stocks, most of which you will have probably heard of. Below is a break down of how I categorise these stocks and why they are currently in my portfolio:

Growth Stocks

Growth stocks are companies which are actively expanding their businesses. They generally pay little or no dividends and can fluctuate in value based on the demand for the service or product they offer.

If a company is meeting its financial targets and has a strong media presence, it often builds confidence in investors and the price per share will rise.

Conversely, if the company is not meeting its targets or is suffering from bad press or legal disputes, investor confidence will decrease and the stocks value will in turn decrease.

The main growth stocks in my portfolio include:

Amazon -AMZN

I bought this stock at a time in which its value appeared low. Amazon has demonstrated it has a tremendous ability to carve its own path in the market and has quickly become a go to shop for many people. I currently do not believe Amazon has finished growing in value at this stage and have seen my original investment in the company double at the time of writing.

Cameco – CCJ

With the growing trend of AI, there is a real push for vast amounts of clean energy. Cameco is company which mines uranium, one of the key materials required to produce nuclear energy.

Cameco is based in Canada and has strong trade relations with the USA so could play a large part in the supply for the builds being fronted by Google and Microsoft.. These relations could faulter should Trump proceed with a 25% tariff charge on imports from Canada.

Sandvik – SDVKY

When reviewing Cameco values, they claim to “emphasize the use of local suppliers first. In northern Saskatchewan”.

Sandvik is a company actively working in Saskatchewan and produces industrial mining equipment. They have also recently won a 1.9billion dollar contract working with BHP in the Jansen Potash Project which sees to create the largest potash mine to date. They appear to be a company with the ability to back extensive mining projects which may see further earnings off of the back of Cameco’s success should the two companies collaborate.

NVIDIA – NVDA

I was very late on board with the Nvidia hype which saw the companies stock value increase 200% between January 2024 and November 2024.

My investment was shortly after this peak, anticipating a secondary boom as AI models develop.

Dividend Stocks

A dividend stock is a stock that pays a percentage of the profit to its shareholders at agreed intervals. In addition to any growth that the company achieves in its market value, you will also make earnings based on the total number of shares you hold.

Companies that reliably pay dividends are often well established, long standing companies at the peak of their growth. The dividend yields will not be excessively high and will fall comfortably into the companies spending.

Too often you will see companies offering unsustainably high dividend yields to attract inexperienced investors or mask another potential problem within the books. My experience to date, has been to avoid these companies like the plague.

The main dividend stocks in my portfolio include:

Coca-Cola – KO

This company has reliably paid, and increased dividends for a minimum of 20 years as can be seen by the graph on the Dividend Investor website.

Looking further back in their history, they have a record of paying that far predates this. This, alongside a solid set of accounts, feels like as safe of an investment as any for generating regular dividend payments.

Games Workshop – GAW

Games Workshop has a solid reputation for paying dividends since 1995 with the exclusion of the financial crisis 2008 – 2009 where they cut dividends as an act of self preservation. This to me, is a perfectly viable decision to protect the business for the long term and not focus on short term gains. It also fall in lines with the company’s dividend ethos where they state:

“We will only pay dividends out of cash which is truly surplus to the business, after making allowance for the costs of new retail store openings, regular capital expenditure and maintenance, investment in tooling, plus a sum to ensure the business has sufficient working capital for its needs.”

While I personally do not use the product they sell, I love what the company stands for and the global outreach it has achieved.

Procter & Gamble – PG

Much like Coca-Cola, this company has consistently paid dividends for at least the last 20 years. The company is involved with all aspects of many of the leading brands across consumer goods..

You will undoubtedly have one of their products in your home. They have demonstrated they have a fantastic ability to research, manufacture, market and finally get their products into our homes.

Exchange-Traded Fund (ETF’s)

An Exchange-Traded Fund is a stock that contains a number of assets all under the umbrella of the main stock. They are managed by a third party and can be a great place to put your money if you are not yet prepared to explore other options. In fact, they can be a great place to put your money when you are prepared to look at other options to!

Vanguard S&P 500 (Dist)

One of the most popular ETF’s on the market is the S&P 500 which contains 500 key businesses in America. The S&P 500 gives you instant access to a diverse portfolio of stocks and has retuned an average of c.10% growth per annum over the last 10 years. This is no small feat, one that most fund managers are not able to beat after including their fees.

With the above in mind, my ETF of choice is the Vanguard S&P 500 (Dist). The dist stand for distributing, which means that all dividends earned will be paid back to the shareholder. The opposite of this is (Acc) which stands for accumulating. The sees all dividends reinvested back into the ETF automatically.

The Strategy

I have no doubt my strategy will change throughout the course of this project. Naturally, there are certain months where I will be able to invest more than others and while I’ll avoid it at all costs, if it benefits me to utilise the funds within my trading account elsewhere, I will not pass on the opportunity.

For the month of December, my investment strategy will look like this:

| Type | Invest % | Week 1 | Week 2 | Week 3 | Week 4 | TOTAL |

|---|---|---|---|---|---|---|

| ETF | 40% | £25.83 | £25.83 | £25.83 | £25.83 | £103.33 |

| Growth | 20% | £12.92 | £12.92 | £12.92 | £12.92 | £51.66 |

| Dividend | 40% | £25.83 | £25.83 | £25.83 | £25.83 | £103.33 |

| TOTAL | £258.32 |

Week 1 Allocations

- The 40% budget allocated to the ETF will be placed in the Vanguard S&P 500

- The 20% Growth budget will be placed in Cameco for week 1

- The 40% Dividend budget will be split between Games Workshop, Coca-Cola and Procter & Gamble

Begin Your Journey!

Why not take this time to begin your journey and start to grow your money by investing! When it comes to investing, the most valuable resource, aside from the capital to put in, is time. There is literally no time like the present!

If you haven’t already and you are 18 or over, I recommend looking into a Trading212 Stocks and Shares ISA where you can begin investing your post tax income up to the value of £20,000 per annum. Any gains or dividends made in this ISA will be tax free.

Come back and join me over the upcoming weeks to see how we progress on this journey.