Welcome to week 11 of this portfolios journey to £10,000. Find the full description of this project and the outline of the goals here at week 1

The updates in this article will see this portfolio reach 23.6% of the goal

Last week change +0.6%

⚠️ Disclaimer ⚠️

I am not a financial adviser, and the information I share is based solely on my personal investment journey as an average individual. Please remember that past performance of the market is not a guarantee of future results. Always do your own research and consider seeking advice from a qualified professional before making any financial decisions. Only invest what you are willing to accept losing.

Last Week’s Portfolio Performance

It was another bearish week, with a number of stocks losing value on the market seeing a £24.08 drop in portfolio value. While it is always disappointing to see the figure decline in the week, it must also be seen as an opportunity to purchase shares in companies that you believe in at a better price.

The biggest losses by % are currently Cameco and AECOM. I have spoken often of Cameco and my thoughts on the future of this company in previous posts (see here), so I shall not dive too deep into it in this one.

The biggest losses in monetary terms are Cameco again, and the S&P 500. While the S&P 500 is only down 2.85% in the last week, this does make up over 40% of my portfolio which means each shift in the market has a greater effect on the final figure.

Upset In The S&P 500

It was announced across several media channels this week that Warren Buffett has sold his holdings of the S&P 500. Shortly after this news, investors began following suite and selling their holdings in unison. This has resulted in a significant dip this week.

Should we be worried about this? My thoughts are no, we should not.

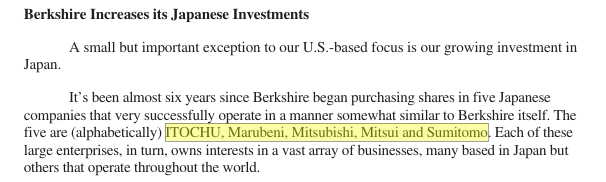

Warren Buffett and Berkshire Hathaway are managing a multi-billion dollar portfolio, spread across equities, cash and cash equivalents, wholly owned businesses and shares in large corporations. Their business extends their reach globally, even taking advantage of investment opportunities in Japanese businesses including ITOCHU, Marubeni, Mitsubishi, Mitsui and Sumitomo with great success.

BERKSHIRE HATHAWAY INC. 2024 ANNUAL REPORT – Page 10

Buffett has publicly discussed the benefits of the S&P 500 and power of passive investing on many an occasion. In fact, in one instance, there are reports of him winning a $1 million bet that no professional investor could select 5 stocks and outperform the S&P 500 index fund over 10 years after fees. See Investopedia for more on this.

Buffett and his team are clearly very skilled at what they do and the sale of this is likely a way of reallocating capital, moving it away from areas outside of his control and into wholly owned businesses – potentially increasing exposure in Japan.

For me, I see Berkshires shift of capital allocation and the response of the market as small window of opportunity to purchase additional shares in a managed equity because let’s face it – if I had the skills of Mr Buffett himself, I would not be working my way towards £10,000 right now!

NVIDIA’s Financial Report

NVIDIA released a very promising report for the end of the financial year, boasting a 114% and increase of full-year revenue, totalling $130.5 billion.

The company also had a record final quarter, up 12% from the quarter before and 78% from the year before, amounting to $39.3 billion.

In addition to the incredible results above, NVIDIA is projecting a $43 billion first quarter revenue!

See their press release here.

This Week’s Investments

This week, I will not be carrying out the usual 40:20:20 split between an ETF, higher risk stocks, dividend stocks. Instead, I will adjust my approach to fall in line with the opportunities the market is presenting.

I will be making the most of the recent dip in the S&P 500 and allocate 50% of the £100 into VUSA.

For the second 50%, I will be purchasing additional stocks in NVIDIA. I originally purchased the stock at a high price and I would like to reduce the price paid per share before the next quarter ends.

Next Week…

There will be no update next week, but join me the week after for a further update on this portfolio as we journey our way to £10,000.

If you missed last week, you can find it here.

If you like these articles and are interested in the progression of this portfolio, click the like button at the top or bottom of this article. Your input means a lot and will help to shape the future of this blog.

Have a great week!