What a time to begin this journey.

Stock values are falling at a rapid rate, as many investors aim to redistribute their money into safer investments. Since the end of January, the VUSA S&P 500 has fallen by 18.6%, just 6.4% off the same drop we saw during the Covid pandemic.

It is easy to see why the above may instil fear, particularly for those with large sums of money in the stock. Think about it – if you had £100,000 in the VUSA S&P 500 on 27th January, over the last 10 days, you would have seen your portfolio drop by £18,600 in unrealised gains.

It would be equally intimidating if you were at the point in your life where you wish to start using the wealth generated from your investments. Honestly, if I were also at this stage, I’m not too sure what I would be doing with my money right now.

One thing we can do is zoom out and explore what has happened historically during times of market unrest.

The updates in this article will see this portfolio reach 23.3% of the goal

Last week’s change -1.6%

⚠️ Disclaimer ⚠️

I am not a financial adviser, and the information I share is based solely on my personal investment journey as an average individual. Please remember that past performance of the market is not a guarantee of future results. Always do your own research and consider seeking advice from a qualified professional before making any financial decisions. Only invest what you are willing to accept losing.

Market Vulnerability

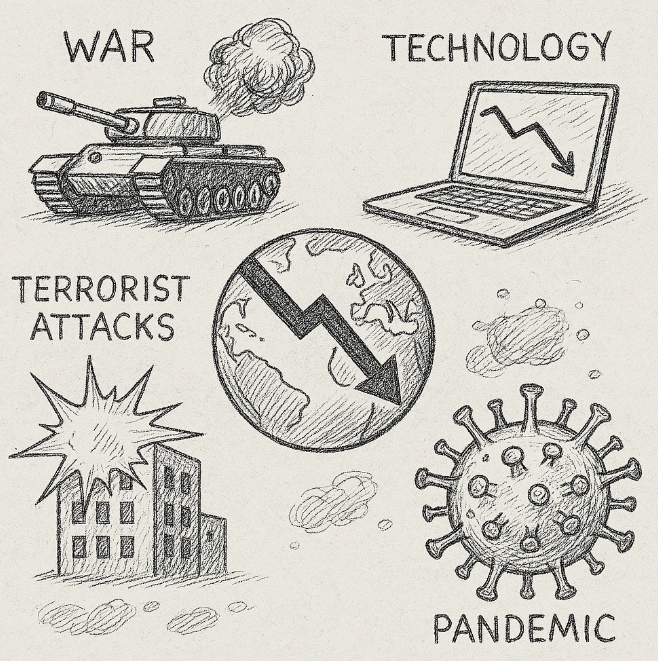

Unfortunately, there are rarely many years between global events that directly affect the economy and people’s lives. We have seen numerous crises from wars, terrorist attacks, industrial decline, depressions, and the overvaluation of businesses due to the introduction of new technology, many of which have occurred in the last few decades.

The purpose of this article is not to look deeply into each of these events but instead to examine the effects on the market.

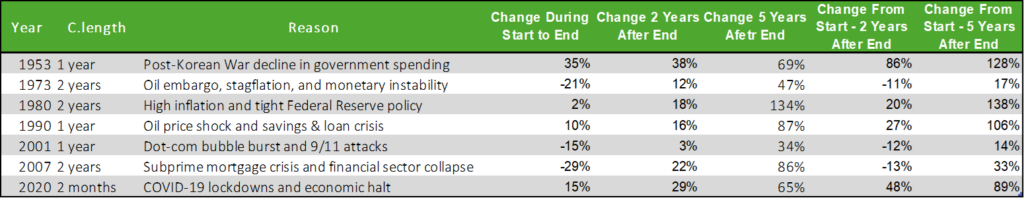

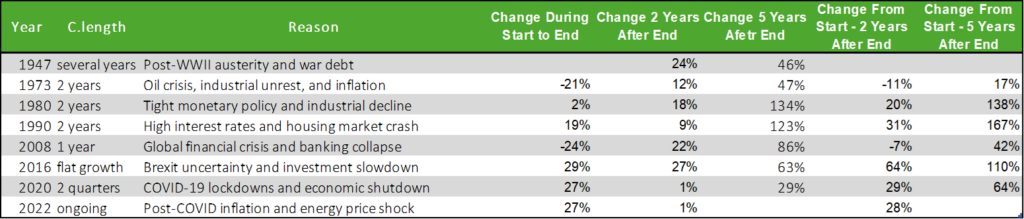

Below are two tables showing some of the key historical events in both the US and UK and the markets’ response to them.

Please Note: The events have been collated using an AI model. Percentiles have been derived from Google Finance data, taking the highest value for the year described.

United States – Change in S&P 500 Following Key Events

United Kingdom – Change in S&P 500 Following Key Events

Summary of Market Responses

The tables above give us an interesting compact overview of decades of events that have impacted the market. We can extract the following insights:

- Most market shake-ups last between 1-2 years.

- 2 years after the end of an event, markets generally show strong recovery, although sometimes not quite back to the value pre-event.

- 5 years after the event, markets have generally fully recovered and are thriving, often exceeding pre-event values, sometimes by double.

- The market has not dropped below 29% of its starting value, with the average of all events resulting in a 22% drop.

This Portfolio Challenge

This challenge presented a 3-tier completion system:

- Gold – Complete before January 2026. The equivalent of £192 per week investing with no gains in the portfolio.

- Silver – Complete before July 2026. The equivalent of £128.20 per week investing with no gains in the portfolio.

- Bronze – Complete before January 2027. The equivalent of £96.16 per week investing with no gains in the portfolio.

It is highly likely, almost certain, that markets will continue to drop moving forward. The question is: when will they begin to recover?

With wars taking place around the world, uncertainty with trade, and new technology flooding the market in the form of AI, there are many factors in play that could impact the economy and, as a result, the stock market.

Based on everything presented above, my initial thoughts are that we will not see significant recovery in 2025. Should this be the case, this portfolio will be highly reliant on deposits to increase its value over the next 8 months if it has any chance of reaching the £10k mark.

Following this period, I believe we will see the market reach new heights. When trade settles, looming recessions influence interest rates, and companies are utilising new technology with a far greater understanding, I believe spending will increase and revenue per person will rise significantly across many of the big players. Strong company performance will encourage investors to flood the markets to buy the climb.

Essentially, I see this as a dip before a bigger climb. It is within this dip that I want to make the most of the lower market prices and get as much of my expendable capital into the market as possible. I think now would be a good time to say:

Only invest what you are prepared to lose!

This Week’s Investments

This week, I will be investing £75 across 2 stocks.

£50 will be invested into the Vanguard S&P 500. In the last 4 days, this ETF has lost me over £76.

The remaining £25 will be invested in Realty Income. If interest rates do drop this year, this could result in Realty Income utilising capital to increase its operating income by buying more properties and lowering its operating costs.

Next Week…

Keep an eye out next week for a further update on this portfolio as we journey our way to £10,000.

If you like these articles and are interested in the progression of this portfolio, hit the like button at the top or bottom of this article. Your input means a lot and will help shape the future of this blog.

Have a great week!