It’s Christmas week and the show must go on.

To see the beginning of this project and the approach for the upcoming weeks, see week 1 here! In this article we take a look into the SMART objective setting and break down the current portfolio.

If you have already seen this and are following along, welcome back to week 2!

Current Progress – 15.7% of goal

First, a quick disclaimer – although my lack of experience may be evident, I do want to make sure the angle from which I am approaching this project is clear…

Disclaimer

I am not a financial adviser, and the information I share is based solely on my personal investment journey as an average individual. Please remember that past performance of the market is not a guarantee of future results. Always do your own research and consider seeking advice from a qualified professional before making any financial decisions. Only invest what you are willing to accept losing.

With that done and dusted, let’s have a look at the last week of investing…

Additional Income

As I’m sure is true for some of you this Christmas period, I was fortunate to receive some money through gifts. With this in mind an additional £100 beyond the original stated amount has been allocated to investments, split evenly between Cameco and Sandvik, with £50 each.

Using unanticipated money, such as bonuses, tax refunds, or gifts, to improve financial wealth instead of spending it on material items is a strategy I would encourage anyone to adopt.

Assess what task is most important to you and use this unexpected income to reduce debt, build an emergency fund, invest in stocks or your own education and you can be sure that your money is more likely to be working towards long term financial stability than spending it on material goods that provide short-term satisfaction.

A little bit more about the two companies that I have decided to place my additional income with has been included below…

Sandvik-SDVKY

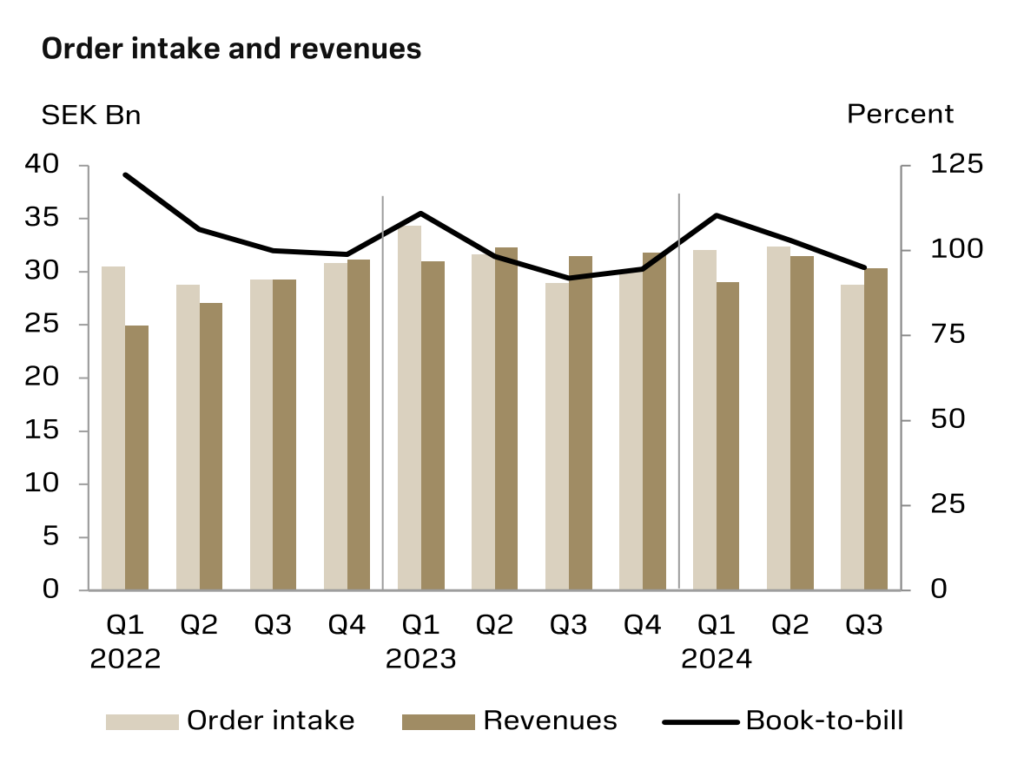

Sandvik reported a promising intake of orders in their mining operations during Q1 and Q2, which may influence the books for Q4. These will be released towards the end of January 2025.

Sandvik also has strong cash flow, which is steadily improving. This adds additional confidence when investing in the company as it shows management is utilising their capital well. This will support the company during challenging periods and ensure they are well-positioned to quickly and efficiently leverage any opportunities that arise.

The reports for Sandvik can be found here if you wish to analyse these and draw your own conclusions for yourself.

Cameco – CCJ

Cameco are a company that are confident about their future. Several recent scenarios have worked in their favour, including an increased volume of uranium (1 million lbs) at one of their mining sites and a higher realised price of their product due to the strength of the US dollar.

Cameco has suggested it will increase its dividend by 100% of the 2023 rate of 0.12p per share to 0.24p per share by 2026 showing they are willing to give a portion of their success back to investors.

Despite Cameco’s recent successes and strong cash flow, we must remain mindful of the potential 25% tariff on imports, which could be imposed if the U.S. and Canada fail to reach agreements on reducing illegal immigration and drug trafficking across the border. These tariffs could be in place by as soon as the end of January 2025.

On 24th December 2024, Insider Monkey published their top energy stocks to invest in. Within this article they gave some great insights into the company and rated Cameco 7th. Check it out for yourself here.

Detail of Cameco’s Q3 report can be found here.

Last Week’s Portfolio Performance

There has been a slight drop in the return percentage, primarily due to a decrease in the value of the two growth stocks mentioned above. For the reasons mentioned above and in my previous post, I will persist with these moving forward in the hope that these will contribute towards the long term goal of reaching the £10k mark.

Both Amazon and Coca-Cola finished lower than the beginning of the week which has contributed to this drop in percentage. This is partly due to a general market downturn but also because of some minor business operational challenges, both in line with how cost effectively they are able to operate and ultimately the cost of the final product or service they offer.

A £1.63 dividend was received from the Vanguard S&P 500, along with 0.20p in interest on uninvested cash. Small change I know, but equally there is only a small amount invested at this stage.

This Week’s Investments

This week, i’ll be sticking to the main plan with the original deposit. This is discussed in greater depth in week 1. 40% of the weekly budget will be allocated to ETFs, 40% to dividend stocks, and the remaining 20% to slightly riskier growth stocks.

With only one ETF in the portfolio, £25.83 will be allocated to the Vanguard S&P500.

As extra income has been allocated to Cameco and Sandvik this week, I will take advantage of the small drop in value of Amazon’s share price and allocate £12.92 to this for the 20% growth portion of this weeks investments.

Finally, for the 40% dividend stock allocation, the remaining £25.83 will be used to purchase additional shares in Procter & Gamble, reducing the average price paid per share.

Next Week…

Keep an eye out next week for a further update on this portfolio as we journey our way to £10,000.