The updates in this article will see this portfolio reach 27.5% of the goal

Last week change +1.8%

⚠️ Disclaimer ⚠️

I am not a financial adviser, and the information I share is based solely on my personal investment journey as an average individual. Please remember that past performance of the market is not a guarantee of future results. Always do your own research and consider seeking advice from a qualified professional before making any financial decisions. Only invest what you are willing to accept losing.

Last Week’s Portfolio Performance

For the second week running, this portfolio saw a 1.8% increase. This was the result of a 1.1% return on cash investments and a 0.7% increase in holdings.

We’re beginning to see several stocks rise in value once again, and as a result, the Vanguard S&P 500 is following this positive trend. Last week, it rose by 3.6%, recovering after hitting its lowest point since May 2024 at the start of April.

Amazon grew by 0.5% last week, a relatively low figure due to a press release stating that several sellers may not participate in Prime Day this July. This could affect turnover forecasts, particularly for goods produced in China, as the 145% tariffs are still in place.

From Monday through Wednesday, we saw a drop in NVIDIA’s value, with reports suggesting that China’s Huawei is producing AI chips that will outperform NVIDIA’s product at a lower price. Despite this, NVIDIA’s stock ended the week 2.9% higher.

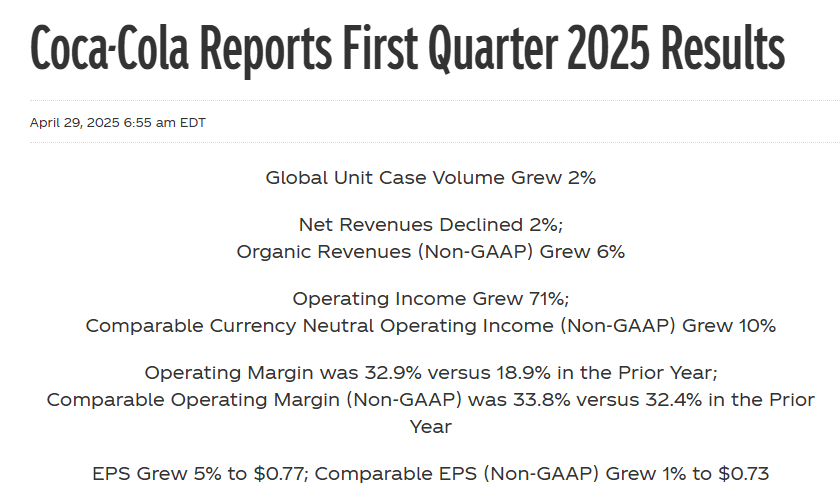

Coca-Cola spiked mid-week after a positive earnings report. The company’s revenue from core operations grew by 6%. However, its net revenue dropped by 2% after accounting for all associated costs. You can view the full report here.

Games Workshop reached an all-time stock price high this week. With regular contributions to investors in the form of high dividends and strong earnings reports, the company is gaining interest from investors.

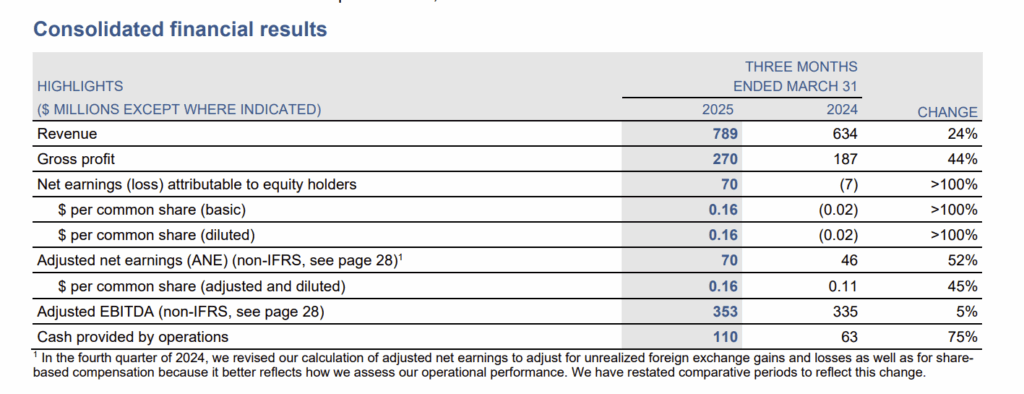

Cameco’s Q1 report can be found here.

Cameco is showing strong performance, with revenue increasing by 24% and gross profit growing by 44% in the first quarter of 2025. Uranium, a product benefiting from tariff exemptions, has put Cameco in a prime position to benefit from its growing demand.

This Week’s Investments

This week, I will be investing £110 in the following stocks:

- £55 will be invested in Cameco. With the pound strong at the moment, each pound will purchase $1.83 CAD of stock.

- £55 will be invested in AECOM. There is strong sentiment that the company will produce a solid set of earnings reports in May.

Next Week…

Keep an eye out next week for a further update on this portfolio as we journey our way to £10,000.

If you missed last week, you can find it here.

If you like these articles and are interested in the progression of this portfolio, hit the like button at the top or bottom of this article. Your input means a lot and will help to shape the future of this blog.

Have a great week!