Welcome back to week 4 of this journey from £500 to £10,000.

In the early stages of investing, the growth of the portfolio mostly consists of deposits made into the account. This means that the most productive thing that can be done to build the account quickly, is both reduce unnecessary expenses or increase income to provide a greater amount of investable capital each month.

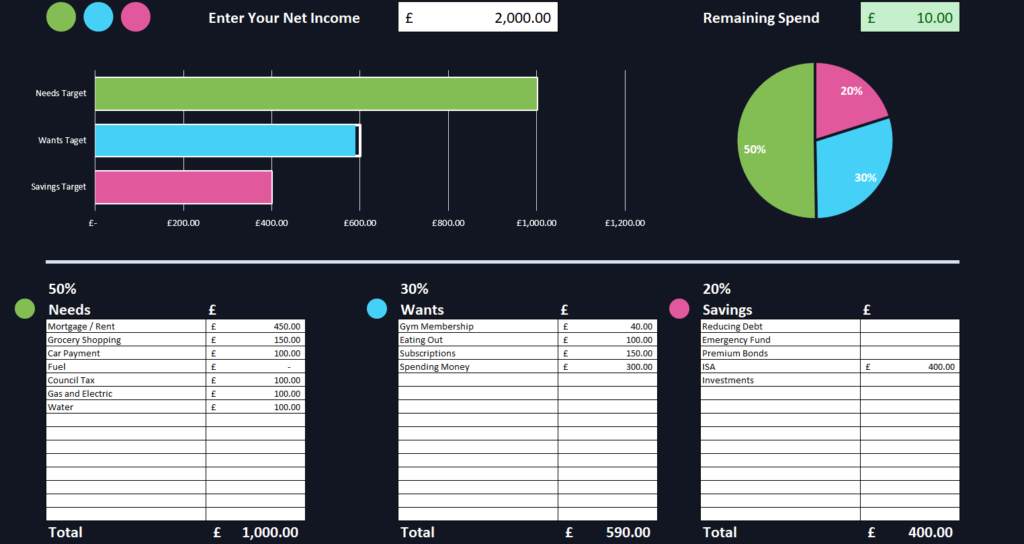

Increasing one’s income is often harder than reducing one’s expenses, so it usually makes sense we focus on what our outgoings are first. There is a fantastic, simple to follow ratio that can help you get started if you are unsure about your spending habits. This is known as the 50/30/20 budget rule.

The 50/30/20 budgeting rule is a method used to distribute your net salary into three key areas. The rule suggests that no more than 50% should be allocated to the things you need, 30% to the things we want and 20% towards the amount we save.

To learn about this rule further and get your free downloadable spreadsheet to calculate your own split, check out my article:

“Master Your Finances: A Complete Guide to the 50/30/20 Budgeting Rule”

The updates in this article will see this portfolio reach 17.4% of the goal

Last week change +0.9%

As always, a quick disclaimer – although my lack of experience may be apparent, I feel it is really important to make sure it is clear the perspective from which I am approaching this project…

Disclaimer:

I am not a financial adviser, and the information I share is based solely on my personal investment journey as an average individual. Please remember that past performance of the market is not a guarantee of future results. Always do your own research and consider seeking advice from a qualified professional before making any financial decisions. Only invest what you are willing to accept losing.

Trading 212 Changes – January 2025

Trading 212 has recently changed the way it displays a users metrics which appears to have had mixed reactions across the investment community. While change is tricky, I’m sure as we use the system more, we will begin to see the benefits of these changes moving forward.

The home screen now provides us a view of the following metrics:

Value – The overall value of everything in your account. This includes both the money invested and the cash portion of your account.

Total Return – This metric shows the total profit or loss for your portfolio. This return is inclusive of dividends paid, interest from cash, foreign exchange fees and taxes.

Rate of Return – This shows the growth of loss of a portfolio over a given time. We will be using this metric sto show the changes week on week within the current portfolio.

Net Deposits – This shows the difference between the cash deposited and the cash withdrawn. This is useful to see how much profit has been realised with your account.

Last Week’s Portfolio Performance

Last week saw the largest drop in the portfolio since beginning this journey. This dip has mostly been due to the holdings held in Canadian stocks and the uncertainty of the market amidst the discussions about the implementation of tariffs on Canadian exports.

Should this take place, the Canadian dollar could reduce in value and alternative trade relations may be sought. Canada may also retaliate imposing tariffs on US exports which could further damage trade relations and even affect local businesses that rely on the US for their imports.

Amongst this uncertainty, the Canadian PM Justin Trudeau announced his resignation, leaving even further ambiguity about the future.

Cameco (CCJ), who carries out a large volume of exportation to the US saw a drop of 8.55% in the last week. Sandvik (SDVK) also saw a drop of 0.22%.

The next biggest stock to be hit in the portfolio was Nvidia (NVDA) in anticipation of the US inflation reports. Should inflation increase, this will hit businesses profits and reduce their disposable income. The Federal Reserve may then increase interest rates to combat inflation which in term could make borrowing capital expensive – not ideal for a growing tech stock.

This Week’s Investments

This week, I have changed the way I classify what I originally determined as growth stocks. Instead, I will call these high risk stocks. Essentially, this smaller portion of my investment portfolio will be allocated to stocks I believe may do well in the future.

Thee high risk stocks are the ones that could bring in the largest earnings, however, they could quite easily incur the largest losses. The ratio I currently feel comfortable with is 80:20 with the 80% being what I feel are safer options and the 20% being the riskier.

Looking as the split more closely, £100 will be divided as follows:

- 20% towards high risk stocks

- 40% towards dividend stocks

- 40% towards ETFs

High Risk Percentile

A new stock will be added to the profile this week, this stock is AECOM (ACM). This company is involved in all elements of planning, construction and engineering and has an impressive portfolio of projects. This is a company that looks to be winning a number of contracts and has had involvement with nuclear energy in the past.

This week, I will be investing the entire 20% into this stock.

Dividend Percentile

The entire 40% will be allocated to Realty Income in this weeks deposit as I would like to build the REIT section of my portfolio up further.

More detail about why I chose Reality Income can be seen here in last weeks post if you missed this.

ETF Percentile

Keeping it consistent, the 40% ETF allocation will be used to purchase more of the VUSA S&P 500. No surprises on this one!

Next Week…

Keep an eye out next week for a further update on this portfolio as we journey our way to £10,000.

If you missed last week, you can find it here and to follow the journey from the beginning you can do so here at week 1

If you like these articles and are interested in the progression of this portfolio, hit the like button at the top or bottom of this article. Your input means a lot and will help to shape the future of this blog.

Have a great week and happy investing!