Welcome back to week 5!

This week, there is no spare capital in which I can invest so I will be using this time to check over the portfolio and review its performance over the last week.

The updates in this article will see this portfolio reach 17.9% of the goal

Last weeks change +0.5%

As always, a quick disclaimer – although my lack of experience may be apparent, I feel it is really important to make sure it is clear the perspective from which I am approaching this project…

Disclaimer:

I am not a financial adviser, and the information I share is based solely on my personal investment journey as an average individual. Please remember that past performance of the market is not a guarantee of future results. Always do your own research and consider seeking advice from a qualified professional before making any financial decisions. Only invest what you are willing to accept losing.

Last Week’s Portfolio Performance

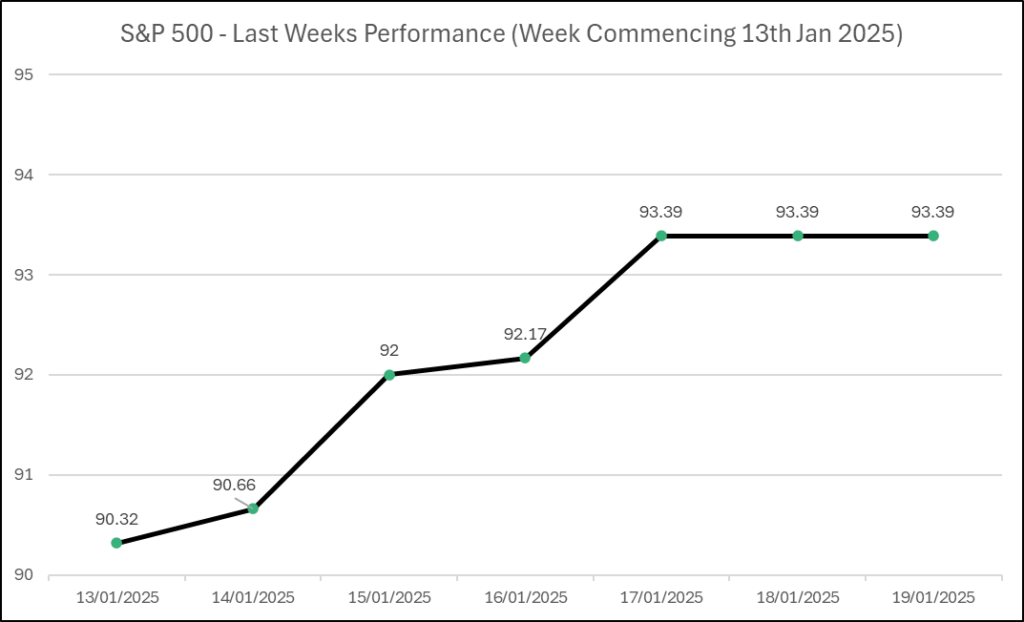

With the current distribution of this portfolio, the market to watch is the American market. This can be best done by reviewing the performance of the S&P 500.

Last week the US market rose significantly from 90.32 to 93.39, the equivalent of 3.5%! This increase has meant there has been a positive change in the portfolio when comparing to the amount of capital invested.

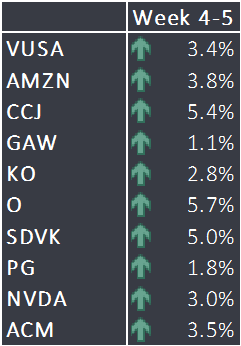

Each stock in the portfolio has seen an increase this week. The greatest increase came within the real estate sector, with Realty Income (O) rising by 5.7%, while the smallest increase was seen in the consumer cyclical sector, with Games Workshop (GAW) rising by 1.1%.

The above has meant that this portfolio has grown by a total of 3.2% (£55.87) this week without any additional capital invested! Is it not amazing how money can begin working for you even with such a small amount invested?

Games Workshop (GAW) Earnings Report

Despite Games Workshop showing the smallest increase in the portfolio, on the 13th of January, they released their half year earnings report and it looked great!

The company has seen growth in both trade and retail at 21.7% and 11.2% retrospectively. Unfortunately, their online sales decreased by 4.2% however, this is due to a suboptimal online user experience, something of which the CEO is fully aware. In fact, £1.5 million of their development budget is being allocated to warehouse facilities, racking and their IT systems.

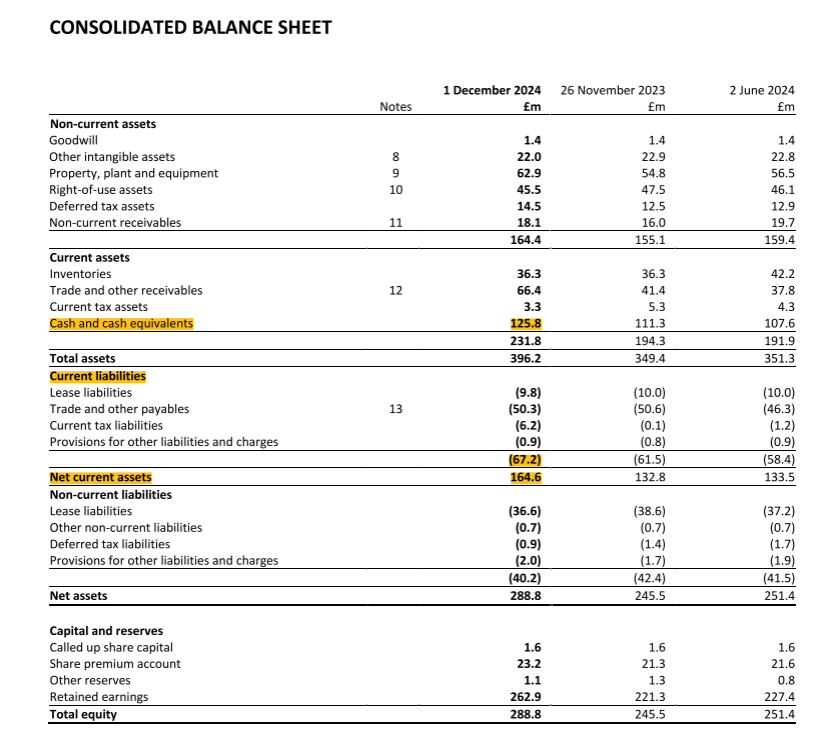

Games Workshop currently has £125.8 million in cash and cash equivalents versus £67.2 million in current liabilities. This is a secure position for the company to be in.

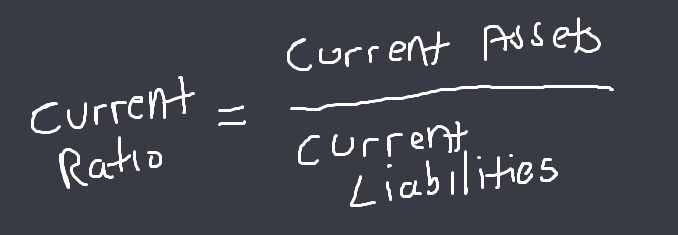

The figures above are needed to calculate something known as the ‘Current Ratio’ for Games Workshop.

To calculate the current ratio, we divide the current assets by the current liabilities. In this example 125.8 (current assets) / 67.2 (current liabilities) gives us a current ratio of 1.87.

This means that Games Workshop has £1.87 of highly liquid assets to every £1 of debt…

Games Workshops income should only continue to rise if their new stores in America, Zurich, Switzerland and South Korea prove to be as successful as the company hope.

US Importation – Trump Tariffs

With Donald Trump’s inauguration set to take place tomorrow (20th January 2025), I will be keeping an eye on what is discussed thereof with regards to the setting of tariffs.

Donald Trump has been vocal about imposing tariffs on the EU, China, Canada and Mexico during his speeches.

Within my portfolio, I hold 2 Canadian companies, Cameco and Sandvik. If 25% tariffs are implemented, I anticipate a drop in stock value while the market adjusts to these changes.

During a recent interview held by CNN with Mélanie Joly, a Canadian minister of foreign affairs, Mélanie felt there was still room for an agreement to be made and the 25% tariff to not come into effect, particularly after Canadas quick response to tighten border controls as per Trumps requests.

Canada invested $1.3 billion into border controls which included a new drug profiling centre, helicopters, drone and watch towers.

Earnings Reports

Several earnings reports for stocks within this portfolio are due to be released soon. These provide key insights into the performance of each business and can help with deciding how to proceed with your investments.

By reviewing these reports you can identify what challenges the company perceives it has and how they plan to address these.

Personally, I like to hold a smaller portfolio and aim to review these when they are released. Each time a stock is added to the portfolio, I am committing to reviewing the companies performance.

Upcoming reports are:

- Procter & Gamble Co – January 21, 2025 at 7 PM

- Sandvik AB – January 22, 2025 at 7 PM EST

- AECOM – February 2, 2025 at 7 PM EST

- Realty Income Corp – February 17, 2025 at 7 PM EST

- Cameco Corp – February 19, 2025 at 7 PM EST

- Coca-Cola Co – February 10, 2025 at 7 PM EST

- NVIDIA Corp – February 25, 2025 at 7 PM EST

Next Week…

Keep an eye out next week for a further update on this portfolio as we journey our way to £10,000.

We will carrying out a number of tasks including:

- Looking to see if we can attain a greater understanding of Trumps plans for his first few weeks in office

- Planning the February investment capital

- Looking at the earnings reports from both Procter & Gamble and Sandvik.

If you missed last week, you can find it here.

If you like these articles and are interested in the progression of this portfolio, hit the like button at the top or bottom of this article. Your input means a lot and will help to shape the future of this blog.

Have a great week!