What an eventful week! With lots going on in the news, a number of stock prices were sent spiraling downwards during the early part of this week. Read below to see how some of the events affected my portfolio, as well as my response to these changes.

The updates in this article will see this portfolio reach 20.3% of the goal

Last week change +1.4%

As always, a quick disclaimer – although my lack of experience may be apparent, I feel it is really important to make sure it is clear the perspective from which I am approaching this project…

⚠️Disclaimer ⚠️

I am not a financial adviser, and the information I share is based solely on my personal investment journey as an average individual. Please remember that past performance of the market is not a guarantee of future results. Always do your own research and consider seeking advice from a qualified professional before making any financial decisions. Only invest what you are willing to accept losing.

Last Week’s Portfolio Performance

DeepSeek R1 – The Markets Response

The AI race is one with companies (and countries) looking to have the best AI models before their competitors. America’s Open AI, Chat GPT model has been at the forefront of this push since its release in November 2022, with versions of its model improving upon each release and offered to the general public through a paid subscription.

People’s confidence in the future of the product was shaken this week after DeepSeek, a Chinese AI company founded in July 2023, released their latest model ‘DeepSeek R1’, claiming improved accuracy and efficiency than that of its American competitor.

Alongside the claim of accuracy, there have been articles released suggesting thismodel cost less to construct and will also require less power to run – and it is Open Source!

As the market reacted to this news, several stocks dropped significantly on Monday 27th January. The S&P 500 was down 2.9% at its lowest point following its close on Friday, NVIDIA likewise was down 17.1%.

Companies connected with the energy sector also saw large losses with uncertainty about the requirements of nuclear energy moving forward. For my portfolio this saw Cameco drop by 15.5%.

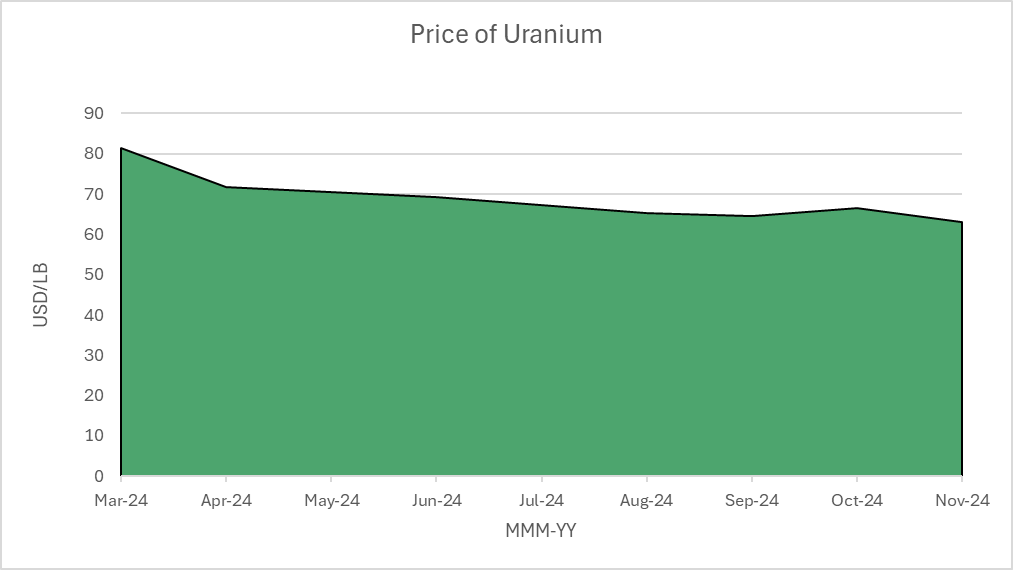

Uranium – A Reduction in Value

Cameco may also be seeing volatility in it market due to a decreasing sale value of the element. This can be seen illustrated nicely on YCharts. Cameco does have the ability to hold onto Uranium for later sale and like other major uranium producers, may manage supply strategically in response to market conditions.

Cameco will be pleased to see their mining activities have now recommenced operations in the JV Inkai operation located in Kazakhstan. Having a 40% stake in this venture will have undoubtedly meant that the delay has had unfavourable financial implications to the company’s finances.

Trump’s Tariff Announcements

Trump has now confirmed tariffs are coming into play starting early next week. As originally announced in previous conferences, both Canada and Mexico will be facing 25% tariffs while China has received a far more favourable 10% tariff, 50% lower than suggestions made during his campaign.

I expect the stock price of Cameco to take a further hit being a Canadian company that supplies to America, however, I still believe this is a stock to hold onto and will continue to do so. Now operations are back underway in Kazakhstan, the company will hopefully begin to see cash flow restored and nuclear still remains as one of the key movements towards clean energy.

The US Department of Energy suggested a drive towards tripling nuclear energy capacity by 2050. I hope to see Cameco benefit from this movement with their global positioning.

This Week’s Investments

During the mad sale of stocks this week, I made a midweek purchase allocating another £40 into Cameco outside of my original plan with the aim of reducing the price paid per share.

This weekend, another £100 will be allocated as follows:

- 20% towards higher risk stocks

- 40% towards dividend stocks

- 40% towards ETFs

Higher Risk Percentile

Originally, I overpaid on NVIDIA, purchasing late into the boom of its stock price in relation to the requirement of chips in AI models. The stock has had a hard time over the last few weeks and I will use this time to purchase additional shares at a lower rate.

Dividend Percentile

This week, the entire dividend percentile will be used to purchase additional shares in Procter & Gamble. The stock is slightly lower than my average price paid and I would like to make the most of this, bringing it down further.

ETF Percentile

The Vanguard S&P 500 is my preferred ETF. I will continue to place this percentile into this to maintain a margin of safety within my portfolio.

Next Week…

Keep an eye out next week for a further update on this portfolio as we journey our way to £10,000.

If you missed last week, you can find it here.