Welcome to week 8 of this portfolios journey to £10,000. Find the full description of this project and the outline of the goals here at week 1

The updates in this article will see this portfolio reach 21.3% of the goal

Last week change +1.0%

⚠️ Disclaimer ⚠️

I am not a financial adviser, and the information I share is based solely on my personal investment journey as an average individual. Please remember that past performance of the market is not a guarantee of future results. Always do your own research and consider seeking advice from a qualified professional before making any financial decisions. Only invest what you are willing to accept losing.

Last Week’s Portfolio Performance

A Twist In The Plot

Share prices fell in Europe, Asia, and the US as a result of the threat of a trade war. Canada responded to the threat of tariffs by issuing its own retaliatory tariffs of 25% on American goods, including beer and wine, household appliances, and sporting goods.

China has also announced retaliatory tariffs including a 15% levy on coal and liquefied natural gas and a 10% levy will be imposed on large agricultural vehicles, trucks, and SUVs.

A slight twist in the plot occurred with Trump agreeing a 30 day postponement on the introduction of tariffs on both Canadian and Mexican trade while tighter border restrictions are implemented. This decision resulted in the Canadian stock Cameco closing at 5.38% higher than the previous day’s close on the 4th Feb, although it continued to ebb and flow in value throughout the week.

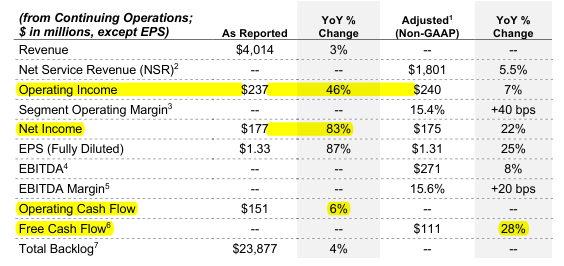

AECOM Financial Report

AECOM’s financial report was released this week on Monday 3rd February and the company displayed some positive financial statistics.

- Operating income was increased by 46% year on year

- Net income was up 83% year on year

- Operating cash flow was up 6%

- The company experienced growth across the board, 8% in the Americas and 2% internationally

- The company has returned $55million back to shareholders

Within AECOM’s risk analysis, they acknowledged one key risk is that they may not be able to service their debt should there be financial implications beyond their control.

This is possibly, the biggest risk with investing in AECOM, particularly while there is volatility in the market due to the unpredictability with global trade.

Dividends

Games Workshop (GAW) have announced its dividend pay-outs at £0.80 per share on the 14th Feb and £1.55 per share on the 28th of Feb. We should be seeing a couple of pounds coming through for the shares held within this portfolio.

I’ll take each small win as it comes!

This Week’s Investments

This weeks £100 will continue to be divided up in the regular fashion:

- 20% towards higher risk stocks

- 40% towards dividend stocks

- 40% towards ETFs

Higher Risk Percentile

With Amazon marching on and dominating their place in the industry, I feel now would be a good time to purchase some more shares.

Amazons full 2024 earnings report showed this company excelling in their field with net income, earnings per share and operating income all up significantly.

Dividend Percentile

This week, I plan to purchase another £40 in Games Workshop (GAW). The company had a fantastic earnings report a couple of weeks ago (read more here) and while there is currently a small dip in the price per share, I’ll jump on this as anyone would with a sale of a product they like look of.

ETF Percentile

For the consistent part of the portfolio, £40 will be placed in the Vanguard S&P 500.

A Look Into The Future

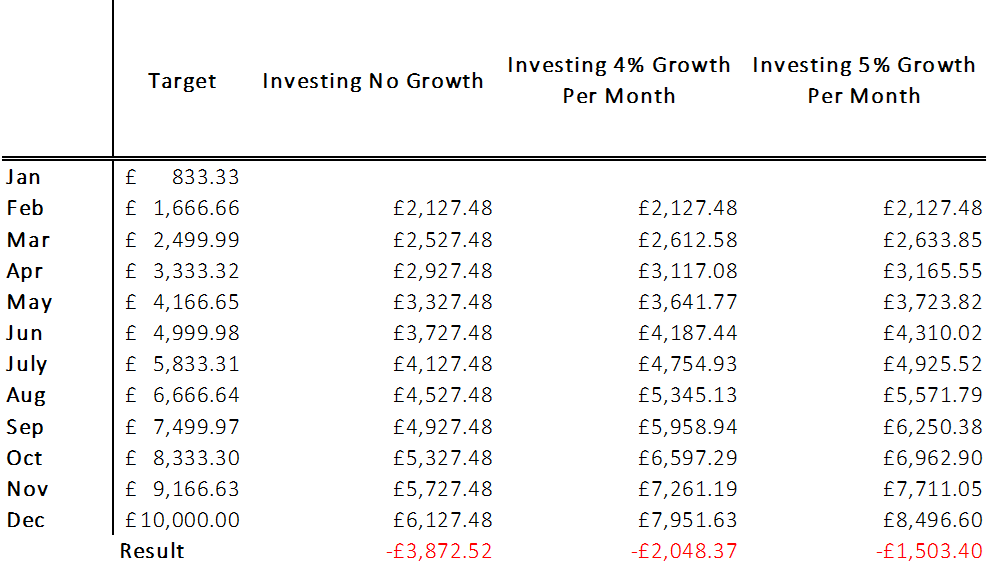

The goal of this project is to grow this investment account to £10,000 in the shortest time I possibly can. I have set a three tier achievement system to help guide this journey. A reminder of this has been included below:

- Gold – Complete before January 2026. The equivalent of £192 per week investing with no gains in the portfolio.

- Silver – Complete before July 2026. The equivalent of £128.20 per week investing with no gains in the portfolio.

- Bronze Complete before January 2027. The equivalent of £96.16 per week investing with no gains in the portfolio.

As it stands, I am targeting a steady investment value of approx. £400 per month with any surplus spare capital heading towards this venture in addition to the £400.

The below table shows where the portfolio needs to be each month to be on ‘Target’, calculating this in a linear fashion. We can also see that if the portfolio was to experience no growth or no loss over the year, we would be over £3,850 short of the goal.

What is interesting to review here, is the effects of compounding. Compounding is the effect that occurs to our money when there is a larger sum of money invested. We begin to earn greater interest, returns and dividends.

If we reassess the portfolio both including a 4% growth and a 5% growth month on month whilst maintaining the steady £400 per month investment, we could be considerably closer to the goal at the end of December 2025.

In January, this portfolio experienced 4.3% growth over the course of the month excluding the cash deposited. This means I know to achieve the Gold target, I will need to explore further options. This includes:

- Investing additional funds where possible.

- Increasing the potential income by focusing on dividends.

- Increasing the growth potential by researching promising growth stocks.

At this stage, I am happy with the strategy in place and will likely be looking towards incorporating additional funds into the portfolio. It is often said the first £10,000 is the hardest to achieve. This is partly due to lessons needing to be learned along the way, but in addition to this it is the limited effect of both compounding and movements in the market.

1% movement of a £1000 portfolio is £10, 1% of a £10,000 portfolio is £100.

You can see above the effect a 1% change makes to two portfolios, one higher in value than the other.

Next Week…

Look out for next week for a another update on this portfolio as we journey our way to £10,000.

If you missed last week, you can find it here.

If you like these articles and are interested in the progression of this portfolio, hit the like button at the top or bottom of this article. Your input means a lot and will help to shape the future of this blog.

Have a great week!