Welcome to Week 9 of This Portfolio’s Journey to £10,000

Find the full description of this project and the outline of the goals at Week 1.

The updates in this article will see this portfolio reach 22.2% of the goal.

Last week’s change: +0.9%

⚠️ Disclaimer ⚠️

I am not a financial adviser, and the information I share is based solely on my personal investment journey as an average individual. Please remember that past performance of the market is not a guarantee of future results. Always do your own research and consider seeking advice from a qualified professional before making any financial decisions. Only invest what you are willing to lose.

Last Week’s Portfolio Performance

Last week, my portfolio performed slightly better than the S&P 500 – but certainly nothing to shout about.

With the S&P 500 taking a 0.45% hit over the week, my portfolio followed the trend, reducing in value by 0.2%. However, the slightly lower reduction was helped by additional holdings in Coca-Cola, Realty Income, Sandvik, and Nvidia, all of which finished the week higher than they began.

Additional Income

In addition to this, I received small amounts of extra income from the following sources:

- £0.11 in interest on uninvested cash

- £0.88 in dividend payments from Games Workshop

- £0.49 in dividend payments from Realty Income

While these are small amounts, it’s exciting to see returns generated from the investments held. I look forward to watching these payments grow as the portfolio evolves.

Coca-Cola’s 2024 Report

A significant factor in Coca-Cola’s share price increase was the release of its full-year 2024 financial report.

The company reported net revenue growth for the full year, with a 6% increase in the final quarter. Despite operating income being down for the year, the fourth quarter showed a 19% increase, indicating strong recent performance.

Although rising costs remain a challenge, Coca-Cola appears to be managing expenses well while creating new revenue streams through alternative beverages such as Sprite Winter Spiced Cranberry and Oreo-flavoured Coke. Additionally, Coca-Cola Zero saw a 13% increase in volume, highlighting the continued demand for calorie-free soft drinks.

Cameco: A Portfolio Challenge

Cameco has been a drag on my portfolio in these early stages, reducing my return on investment by approximately £18. With uncertainty surrounding the company’s future revenue streams, many investors are jumping ship.

The volatility stems from two key factors:

- The fluctuating price of uranium

- Geopolitical tensions related to global tariffs

What Do I Think?

Despite the challenges, I believe Cameco is worth holding for the long term. The recommencement of operations in the JV Inkai project and a backlog of historical contracts should lead to positive earnings reports over the coming quarters, hopefully boosting the stock’s value.

This Week’s Investments

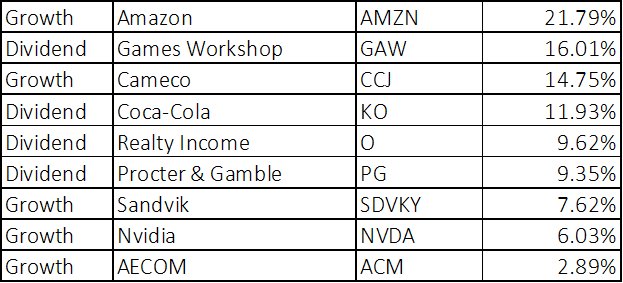

Current Portfolio Breakdown

At present, the S&P 500 makes up around 41% of my portfolio. I see this as the portfolio’s safety net – an area where I have greater confidence that my money is secure for the long term, despite short-term fluctuations.

By removing the S&P 500 from the picture, I can assess how the remainder of the portfolio is distributed. This helps to ensure no single stock is dominating my investments and provides insight into overall risk exposure.

This week, I am using this view to help determine how to distribute my next investment.

This week’s £100 investment will be distributed as follows:

- 20% (£20) into higher-risk stocks

- 40% (£40) into dividend stocks

- 40% (£40) into ETFs

Higher-Risk Allocation

For the higher-risk portion of this week’s investment, I will be adding to my holdings in AECOM. I originally purchased this stock at a relatively high price, so I will use the recent dip to reduce my average cost per share.

Additionally, AECOM currently makes up the smallest portion of my portfolio, making it a logical choice for reinvestment.

Dividend Allocation

For the dividend portion of the portfolio, I will be purchasing additional shares in Procter & Gamble.

A £40 investment will buy approximately 1/4 of a share, pushing my total holdings above 1 full share. Procter & Gamble is also currently trading below my initial purchase price, so this investment will help reduce my average cost per share – much like my AECOM strategy.

ETF Allocation

As per tradition, the 40% ETF allocation (£40) will go straight into VUSA (the S&P 500 ETF).

This continues my commitment to maintaining a strong foundation within the portfolio.

Next Week…

Stay tuned for next week’s update as we continue the journey to £10,000!

If you missed last week’s update, you can find it here.

If you enjoy these articles and want to follow the portfolio’s progress, please hit the like button at the top or bottom of this article. Your support means a lot and helps shape the future of this blog.

Have a great week!