What is the 50/30/20 Rule?

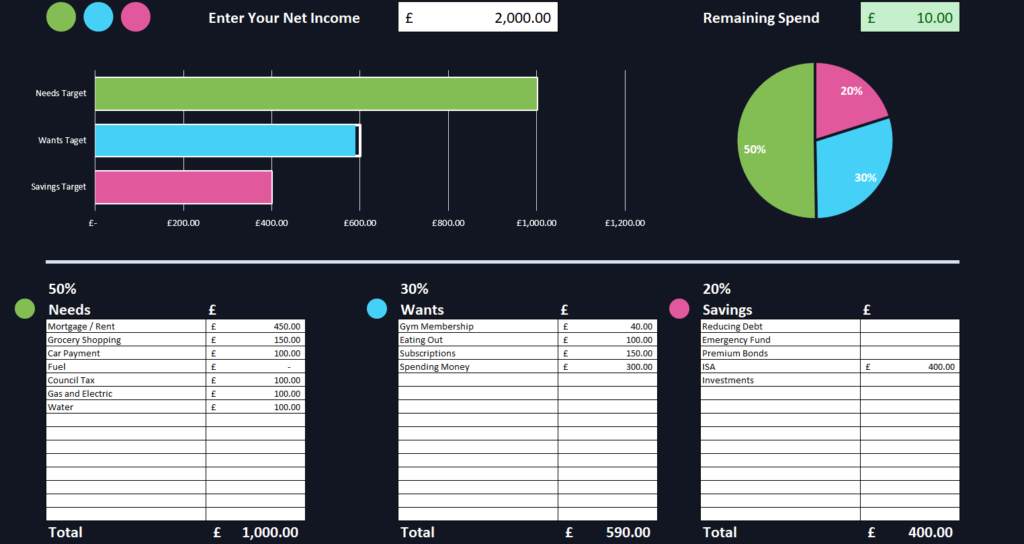

This 50/30/20 budgeting rule shows a suggested break down of your monthly income after tax, otherwise known as your net income. To begin analysing your finances, you must break up all of your expenses into 3 categories called wants, needs and savings.

Who is the 50/30/20 Rule for?

The 50/30/20 rule is for anyone who want to have an understanding of how they are distributing their income!

As you go through these, you may see that one your ratios is out from the suggested figure. If this is the case it is important to understand that this does not mean the ratio is unrealistic, it means that you may be living beyond your means in relation to your income.

You do not have to stick to the percentages outlined by this rule, however, it is great place to start if you have not incorporated a system for manging your finances into your regime already.

How Can I Start?

You can start straight away by downloading this free handy 50/30/20 budgeting template to assess your financial distribution.

Learn what to place under each category by reading on!

How To Use The Free 50/30/20 Budgeting Template

- Download the template and save to a location of your choice. Once this is done, open it up

- Enter your net income into the top of your spreadsheet. This is your salary after all other expenses have been removed including tax, national insurance and pension contributions. The target spending will be shown in the bar graph on the top left and the remaining spend in the top right.

- Fill out the 3 tables Needs, Wants and Savings. Some prefilled data has been included here to help you get started. Feel free to delete this!

- If you need more rows, highlight the entire row and use ‘Insert’ > ‘Insert Sheet Rows’ to keep all formulas and graphs intact.

What Quantifies as Needs, Wants and Savings?

Needs – 50%

Needs include things such as food, energy bills, mortgage/rent, transportation, clothing, phone and internet.

The 50/30/20 principle suggests your needs should not exceed 50% of your net income.

It is extremely easy to exceed this 50% budget and live beyond your means with the temptations available. Financial plans and contracts are readily available to make items we wouldn’t consider buying due to a high price tag even more attractive.

If we remember this percentage, we can quickly determine if we can afford certain purchases without detriment to our future.

Wants – 30%

The suggestion is that 30% of your net salary goes towards the things you want, but do not really need. We have to remove the emotion out of spending habits and be truly honest when asking if the purchase is really a need. It is very easy to convince yourself a want is in fact a need! Avoid doing this….

Wants include things such as gym memberships, TV and app subscriptions, meals, drinks out and day trips. You should also consider things that are beyond the requirement of a need and incorporate it here, for example you made need a rucksack to carry my items in throughout the day which can be bought at a good quality for £30, however, you may want a rucksack that is £100.

If you are ever in doubt if something is a need or a want, trust me, ITS A WANT!

Savings – 20%

The suggestion is that the final 20% of your net income should be allocated towards savings. Despite being last in this list, budgeting in this format does support the motto of “pay yourself first.”

This part of the budget should be treated as definite. 20% minimum, non-negotiable. We can explore changing the ratios of our both wants and needs ratios and even increase our savings ratio, but do not reduce your saving to less than 20% of your net income.

If ratios are adjusted, ensure they remain realistic! Eating less to afford the latest iPhone is not sustainable…

Distributing Savings

To decide where to store your savings, it is always recommended to speak to a financial advisor, which I must be clear and say that I am not.

Some very sound advice that I have been exposed to, is to allocate your savings in the following order:

1. Pay off any debt

Interest rates can see debts increase exponentially. The first focus should be to clear any debts present. The savings made here can be enormous as you will likely never make the interest on the cash you own as you do on the cash you owe!

2. Build an emergency fund

An emergency fund should be the next thing to tackle. This is money that is kept to hand in case things in life do not go our way. This can happen for any number of reasons and should not be overlooked.

We can end up out of work through redundancy, injury or health. We may be needed to provide care for a loved one. We may simply need a change and time away from generating income to focus all our energy on carving a new path.

In any of these circumstances there is a possibility that we may be unable to pay our bills with the money being generated. It is generally recommended that an emergency fund covers 3 months salary, which, if you are following the budgeting rules above will enable you to live for 6 months if you cut back on all wants and savings temporarily.

While quality of life will drop for this period, you know your assets are safe and there is a generous window of time to find a resolution.

3. ISAs & Premium Bonds

In the UK, we currently have the ability to deposit up to £20,000 per annum into ISAs which each have their own benefits. The key benefit across all ISAs is that the money made within them are not subject to capital gains tax.

In the UK, we can also pay into premium bonds which enters our money into a draw to win cash prizes every month. The best bit is these are not subject to tax. Each person can invest up to a total of £50,000 of capital that will eligible for the prize which can draw prizes between £25 and £1,000,000. Keep in mind that you may not win and your money may not beat inflation in this account.

Utilising these benefits can be one of the next best places to store your money until it is required. My personal choice of ISA is a stocks and shares ISA provided by Trading 212 as I see this as one of the greatest places of potentially increasing the value of the money invested.

Summary

Incorporating the 50/30/20 rule into your financial routine can be a transformative step towards achieving stability and long-term goals. By categorising your expenses into needs, wants, and savings, you gain a clear understanding of where your money goes and how to adjust your habits for a more balanced lifestyle.

Remember, this framework is just a starting point. Tailor it to your unique situation, but always prioritise building a strong financial foundation. Whether you are saving for a big purchase, paying off debt, or planning for the future, the key is consistency and discipline.

Take the first step today by downloading the budgeting template and evaluating your financial health. A well-organised budget is not just about numbers—it’s about gaining control, reducing stress, and creating opportunities for a better future.

Good luck, and start budgeting your way to financial freedom!